Showing posts with label us. Show all posts

Showing posts with label us. Show all posts

Thursday, April 13, 2017

New cover art for Codename Omega starring US Army Technical Sergeant Bernard Schaffer Sr

New cover art for Codename Omega starring US Army Technical Sergeant Bernard Schaffer Sr

Codename: Omega has never had a really good cover. The first one by Keri Knutson was the best, but I just wasnt satisfied with it. I wanted something special. Something unique. I messed around with my meager skills trying to create art for it, but no matter what I did, it never came out right.

I wanted something special. Something personal. Something that caught peoples eye.

So while I was looking through my photographs and I found my grandfathers US Army photo. He was really the inspiration for the story, so it seems only fitting that he grace the cover. I needed it to accurately reflect the book, however, so through the magic of digital manipulation, here it is.

Available link for download

Tuesday, February 28, 2017

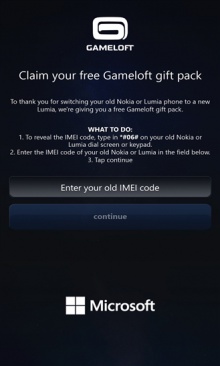

Notícia Gameloft e Microsoft premiam donos de novos Lumias com US 90 em créditos

Notícia Gameloft e Microsoft premiam donos de novos Lumias com US 90 em créditos

A Microsoft segue aumentando o número de parceiras do Windows Phone e sua linha de dispositivos Lumia. Agora, a companhia de Redmond anunciou uma promoção em conjunto com a Gameloft, onde serão liberados US$ 90 em créditos na compra de produtos dentro de alguns jogos da desenvolvedora para quem adquirir um smartphone Lumia entre os dias 5 de junho e 30 de novembro deste ano.

Vale notar que para participar da promoção é preciso que você possua um outro aparelho da linha que tenha sido adquirido em um período anterior a este, sendo o meio da Microsoft de premiar quem continua apostando em seus smartphones. Isto é necessário pois, para resgatar os códigos que liberarão o crédito, você precisará inserir o código IMEI de seu aparelho anterior, bastando então seguir com os passos para participar da promoção.

Promoção da Gameloft premia donos de novos Lumias com US$ 90 em compras dentro de aplicativos

Os jogos participantes desta campanha e seus respectivos prêmios são:

- Asphalt Overdrive – Compre um “Seguro de Ouro” no valor de US$ 19,99

- Pastry Paradise – Compre um “Pote de Medalhas” avaliado em US$ 19,99

- Rival Knights – Desfrute de um “Barril de 1.350 Gemas” no valor de US$ 49,99

Como dito, será preciso possuir dois modelos da linha Lumia, sendo um adquirido no período citado e outro mais antigo, demonstrando assim que você já é um cliente consolidado da marca. Após isto, basta seguir os passos abaixo para resgatar os códigos que darão acesso aos prêmios para os três aplicativos listados:

- Faça o download grátis do aplicativo Switch Gift para seu novo Lumia.

- Abra o aplicativo e concorde com os Termos e Condições

- Uma vez que o aplicativo validar o seu novo smartphone, digite o número IMEI de 15 dígitos do seu Lumia antigo. Ele pode ser encontrado na seção “Sobre” das configurações ou digitando o código *#06# no discador de seu aparelho.

- Após a validação bem sucedida, você deverá inserir o seu endereço de e-mail.

- O app lhe enviará códigos de ativação e instruções finais.

Não há informações sobre a inclusão de outros jogos nesta promoção, porém já é algo que poderá incentivar mais pessoas a comprarem um dispositivo da linha Lumia, tendo em vista que várias outras campanhas da Microsoft dão prêmios para quem adquirir um dos aparelhos, como o caso da assinatura gratuita do Office 365 pelo período de um ano para quem comprar um Lumia 640 ou 640 XL.

Com isso, cresce o número de vantagens em se adquirir os smartphones com Windows Phone, restando aguardarmos para vermos quais serão os próximos passos da dona do sistema e de suas parceiras.

Fonte: Tudocelular

Available link for download

Sunday, February 26, 2017

Nearly half of US households escape fed income tax

Nearly half of US households escape fed income tax

In the April 7, 2010 article "Nearly half of US households escape fed income tax," Associated Press writer Stephen Ohlemacher reports that almost half of all U.S. households pay no income tax. Does this infer that the Tea Party movement is people of modest means advocating for more financial gains for the wealthy?

According to Ohlemacher:

WASHINGTON (AP) -- Tax Day is a dreaded deadline for millions, but for nearly half of U.S. households its simply somebody elses problem.

About 47 percent will pay no federal income taxes at all for 2009. Either their incomes were too low, or they qualified for enough credits, deductions and exemptions to eliminate their liability. Thats according to projections by the Tax Policy Center, a Washington research organization.

Most people still are required to file returns by the April 15 deadline. The penalty for skipping it is limited to the amount of taxes owed, but its still almost always better to file: Thats the only way to get a refund of all the income taxes withheld by employers.

In recent years, credits for low- and middle-income families have grown so much that a family of four making as much as $50,000 will owe no federal income tax for 2009, as long as there are two children younger than 17, according to a separate analysis by the consulting firm Deloitte Tax.

Tax cuts enacted in the past decade have been generous to wealthy taxpayers, too, making them a target for President Barack Obama and Democrats in Congress. Less noticed were tax cuts for low- and middle-income families, which were expanded when Obama signed the massive economic recovery package last year.

The result is a tax system that exempts almost half the country from paying for programs that benefit everyone, including national defense, public safety, infrastructure and education. It is a system in which the top 10 percent of earners -- households making an average of $366,400 in 2006 -- paid about 73 percent of the income taxes collected by the federal government.

The bottom 40 percent, on average, make a profit from the federal income tax, meaning they get more money in tax credits than they would otherwise owe in taxes. For those people, the government sends them a payment.

"We have 50 percent of people who are getting something for nothing," said Curtis Dubay, senior tax policy analyst at the Heritage Foundation.

The vast majority of people who escape federal income taxes still pay other taxes, including federal payroll taxes that fund Social Security and Medicare, and excise taxes on gasoline, aviation, alcohol and cigarettes. Many also pay state or local taxes on sales, income and property.

That helps explain the countrys aversion to taxes, said Clint Stretch, a tax policy expert Deloitte Tax. He said many people simply look at the difference between their gross pay and their take-home pay and blame the government for the disparity.

"Its not uncommon for people to think that their Social Security taxes, their 401(k) contributions, their share of employer health premiums, all of that stuff in their mind gets lumped into income taxes," Stretch said.

The federal income tax is the governments largest source of revenue, raising more than $900 billion -- or a little less than half of all government receipts -- in the budget year that ended last Sept. 30. But with deductions and credits, especially for families with children, there have long been people who dont pay it, mainly lower-income families.

The number of households that dont pay federal income taxes increased substantially in 2008, when the poor economy reduced incomes and Congress cut taxes in an attempt to help recovery.

In 2007, about 38 percent of households paid no federal income tax, a figure that jumped to 49 percent in 2008, according to estimates by the Tax Policy Center.

In 2008, President George W. Bush signed a law providing most families with rebate checks of $300 to $1,200. Last year, Obama signed the economic recovery law that expanded some tax credits and created others. Most targeted low- and middle-income families.

Obamas Making Work Pay credit provides as much as $800 to couples and $400 to individuals. The expanded child tax credit provides $1,000 for each child under 17. The Earned Income Tax Credit provides up to $5,657 to low-income families with at least three children.

There are also tax credits for college expenses, buying a new home and upgrading an existing home with energy-efficient doors, windows, furnaces and other appliances. Many of the credits are refundable, meaning if the credits exceed the amount of income taxes owed, the taxpayer gets a payment from the government for the difference.

"All these things are ways the government says, if you do this, well reduce your tax bill by some amount," said Roberton Williams, a senior fellow at the Tax Policy Center.

The government could provide the same benefits through spending programs, with the same effect on the federal budget, Williams said. But it sounds better for politicians to say they cut taxes rather than they started a new spending program, he added.

Obama has pushed tax cuts for low- and middle-income families and tax increases for the wealthy, arguing that wealthier taxpayers fared well in the past decade, so its time to pay up. The nations wealthiest taxpayers did get big tax breaks under Bush, with the top marginal tax rate reduced from 39.6 percent to 35 percent, and the second-highest rate reduced from 36 percent to 33 percent.

But income tax rates were lowered at every income level. The changes made it relatively easy for families of four making $50,000 to eliminate their income tax liability.

Heres how they did it, according to Deloitte Tax:

The family was entitled to a standard deduction of $11,400 and four personal exemptions of $3,650 apiece, leaving a taxable income of $24,000. The federal income tax on $24,000 is $2,769.

With two children younger than 17, the family qualified for two $1,000 child tax credits. Its Making Work Pay credit was $800 because the parents were married filing jointly.

The $2,800 in credits exceeds the $2,769 in taxes, so the family makes a $31 profit from the federal income tax. That ought to take the sting out of April 15.

Internal Revenue Service: http://www.irs.gov

Tax Policy Center: http://www.taxpolicycenter.org

Available link for download

Friday, February 24, 2017

Friday, February 17, 2017

New Photos of Robert H King of the Angola 3 with US Congressman John Conyers

New Photos of Robert H King of the Angola 3 with US Congressman John Conyers

PHOTOS: Robert King had a meeting this May with John Conyers to discuss prison issues and the Angola 3 case.

Hard Time - promo from Shebafilms Kelly Saxberg on Vimeo.

Available link for download

Subscribe to:

Posts (Atom)